Protecting fraud victims and vulnerable customers

Share privacy‑preserving alerts across institutions—so teams can protect customers faster without exposing PII.

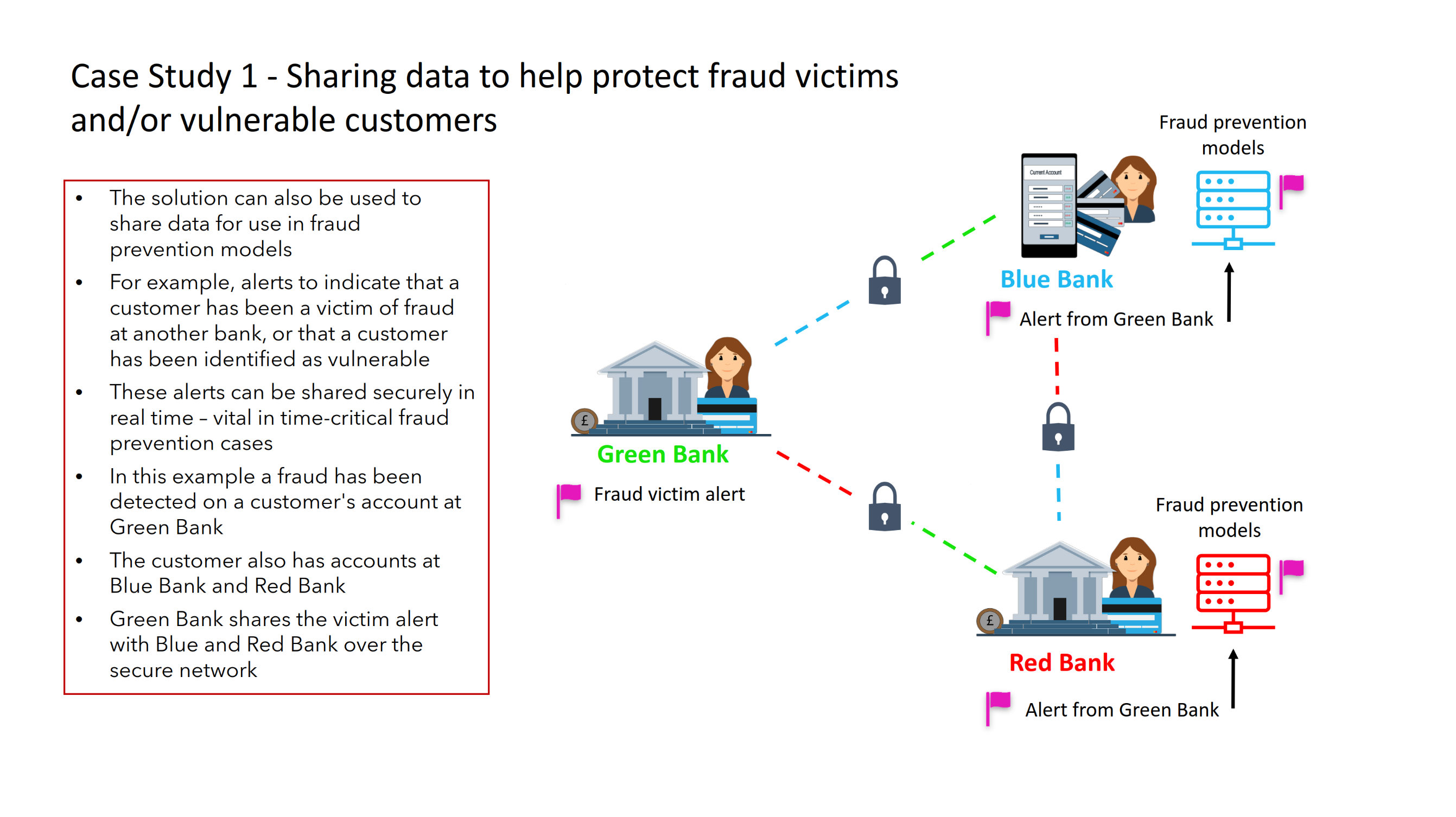

When Bank A confirms a customer was the victim of fraud, it can publish a privacy‑preserving alert to the network. Banks B and C who share the same customer receive the signal in real time and use it as input to their fraud models and controls—without exchanging raw PII.

Similarly, with appropriate consent, vulnerability indicators can be shared across institutions to accelerate interventions for at‑risk customers.