The industry’s data‑sharing problem

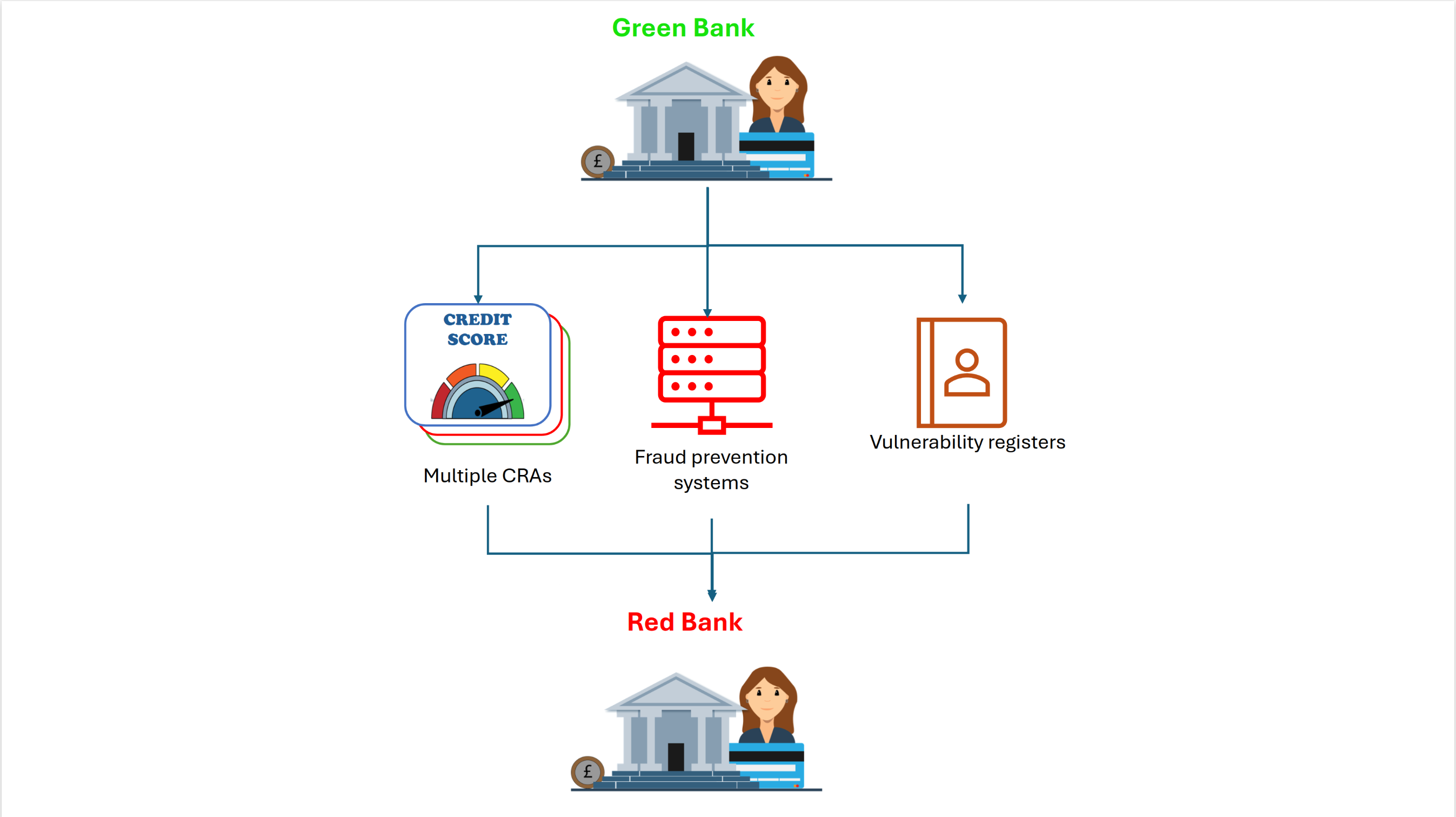

Financial institutions exchange data millions of times a day for fraud, credit and payments. Today this happens through fragmented intermediaries, increasing cost, risk and latency while reducing control over customer data.

Intermediaries add fees and friction, and their opaque models limit explainability. Critically, data often leaves secure domains, creating regulatory and cybersecurity exposure.

This slows decisioning, reduces agility, and stifles innovation. Banks need a direct, secure, and collaborative alternative that keeps PII inside while enabling real‑time intelligence.

What's needed

- Direct, peer‑to‑peer collaboration without exposing PII

- Real‑time matching and intelligence exchange

- Explainable, auditable logic—no black boxes

- Lower cost and reduced vendor lock‑in